2025 Appeals Help Reduce Montgomery County Property Value by $4.2 Billion

O'Connor discusses how the 2025 appeals helped reduce Montgomery County property value by $4.2 billion.

CONROE, TX, UNITED STATES, October 6, 2025 /EINPresswire.com/ --Located in the northern portion of the Houston area, Montgomery County is one of the primary suburbs of Harris County. With many towns, including the middle-class Conroe and the prestigious Woodlands, Montgomery County is seen as being of a higher quality to Harris, while being more affordable than Fort Bend County. Due to this midway point, Montgomery County is quickly becoming one of the most in-demand living places in Texas, though there is a growing commercial sector as well. This influx of people from Harris County and around the country has led to rising property values and taxes in recent years.

Taxpayers are quickly turning to property tax appeals to help lower these costs. While the tax rate cannot be changed, these protests can be used to lower the taxable value of a property, which then forces the tax bill to go down. This is a key strategy in the face of overaggressive taxation thanks to the Montgomery Central Appraisal District (MCAD), as it combines with exemptions to get the fair market value for a home or business. 27% of all properties in the county were protested in 2023 and this trend is only increasing. Initial informal appeals helped counter some major increases in 2025, and new data has just arrived about how formal appeals to the appraisal review board (ARB) did. In this article, O’Connor will discuss how these combined protests were able to stem or even reverse recent value spikes.

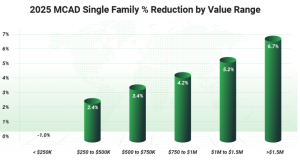

Montgomery County Homes See Value Reduced by 3.1% Thanks to Appeals

In 2025, before appeals, the overall value of residential property in Montgomery County saw an increase of 9%. Informal appeals managed to cut 2% from the total, which resulted in a new sum of $92.23 billion. ARB hearings managed to reduce this further, and when combined with informal appeals, were able to lower things by 3.1%. The largest block of residential value was homes worth between $250,000 and $500,000, which totaled $25.83 billion after a cut of 2.4%. Falling 3.4%, homes assessed from $500,000 to $750,000 took second place with $19.26 billion. Those between $750,000 and $1 million experienced a reduction of 4.2%, while homes worth between $1 million and $1.5 million dropped 5.2%. They were valued at $9.75 billion and $8.11 billion respectively. The most expensive homes got the largest decrease, dropping 6.7% to $7.25 billion.

While the Woodlands is famous for its huge houses, most of Montgomery County has much more modest homes. The largest block of residential value came from homes between 2,000 and 3,999 square feet, which totaled $51.40 billion after a reduction of 3%. Homes under 2,000 square feet were in second place with $19.74 billion after a small reduction of 1.6%. Bigger homes saw more substantial reductions, including 4.5% for homes between 4,000 and 5,999 square feet, which had a combined value of $13.75 billion. Giant luxury homes only combined for a total of $3.9 billion, with large cuts of 6.2% and 6.5% respectively.

Montgomery County’s transformation from mostly wooded areas and rural towns to elite suburbs has only taken a few decades, which is evident when homes are examined by age of construction. 53.8%, or $47.82 billion of the value, was built between 2001 and 2020, and that number is after a decent reduction of 3.3%. Even after a decrease of 3.9% thanks to appeals, homes built from 1981 to 2000 still managed to total $20.61 billion. New construction already accounts for 15.5% of value, which translates into $13.76 billion. While these new homes landed a small reduction of 1.1%, their value had shot up 30.5%. This is a clear indicator that owners of these residences need to focus on appeals, and that they are not just for established properties.

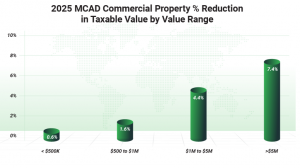

Commercial Value Slashed 5.9% Thanks to Appeals

Commercial properties in Montgomery County took a huge leap in 2025, adding 13.4% in value, reaching a combined $22.90 billion. This was spearheaded by properties worth over $5 million, which grew an astounding 15.8%, accounting for $15.02 billion. Initial appeals were able to bring the total down by 4.3% and this was enhanced by ARB hearings, which pushed the reduction to 5.9%. The largest businesses saw a dramatic slice of 7.4%, while those worth between $1 million and $5 million dropped by 4.4%. The two smallest categories of commercial properties did not contribute much to the total but were still trimmed 0.6% and 1.6% respectively.

Apartments usually top the charts when it comes to commercial value, especially in suburban areas. After an important combined reduction of 7%, apartments still had a taxable value of $6.27 billion. Showcasing how in-demand property is in Montgomery County, raw land achieved a total of $5.24 billion after a reduction of 1.6%. Offices and warehouses followed, while also landing cuts of 5.7% and 7.6% respectively. Hotels saw a huge increase of 76.9%, but this was partially countered by a good reduction of 12%.

When it comes to age of construction, commercial properties generally follow the pattern set forth by homes. 41% of all value was thanks to properties built between 2001 and 2020, which meant a sum of $9.47 billion after a good reduction of 6.5%. After dropping 7.5% thanks to appeals, business property from 1981 to 2000 totaled $3.63 billion. New construction came in like a hurricane, skyrocketing up the charts with an initial increase of 48.3%. This was tamed somewhat by a cut of 9.4%, but once again left room for improvement. New construction landed a total of $2.15 billion. Raw land, listed as “other” on the chart, was responsible for $5.31 billion.

Appeals Help Shield Apartment Owners from Huge Value Jump

Apartments started 2025 by adding 16.5% in value, or so MCAD claimed. This meant that landlords would pass this cost onto renters, worsening an overvalued housing market. Initial appeals were able to cut this by 6%, while ARB hearings made it 7%. While this was not quite half of the increase, it did make a difference. 59.6% of all value was built between 2001 and 2020, which meant a total of $3.74 billion after a reduction of 5.9%. In second place were apartments constructed from 1981 to 2000, even with a drop of 7.7%. New construction added 8.9% in value and this was completely reversed by a combined reduction of 9.3%, which resulted in a total of $1.25 billion. Older apartments accounted for only 4.6% of all value.

MCAD used four subtypes to categorize apartments. Garden apartments were the largest by all metrics, totaling $4.58 billion after being sliced down 6.4%. High-rises were reduced by 8.6%, ending up at $1.51 billion. Subsidized housing dropped to $125.05 million after a 6.6% cut, while generic apartments got a mighty slice of 12.4%, dropping to $55.95 million.

Offices Reduce Taxable Value by 7.1% in Montgomery County

Offices were in third place in taxable value, following apartments and undeveloped land. They likewise saw a construction boom between 2001 and 2020, which resulted in 62.5% of all value. This translated into a sum of $2.25 billion after a combined appeal reduction of 6.7%. 25.6% of office value had origins from 1981 to 2000, though this category did see a substantial decrease of 8.2%. Those built from 1961 to 1980 were responsible for $210.78 million in value, though they saw the largest decrease by percentage with 10.4%. New construction has been rising the charts and already accounted for $184.53 million following a small decrease of 3.8%.

MCAD gave offices only three subtypes. High-rises were at the top stop with $1.50 billion, following an 8.4% reduction. Medical offices were close behind with $1.17 billion and a cut of 5.2%. After a reduction of 7.5%, low-rise offices managed a total of $908.11 million.

Strip Centers Save the Most from Protests

Retail values jumped 9.6% in 2025, reaching a total of $3 billion. Thanks to dedicated appeals, this was trimmed 5.1% to $2.84 billion. Retail spaces followed homes and most commercial properties when it came to age of construction, with $1.5 billion being built between 2001 and 2020, while $890.73 million was constructed from 1981 to 2000. These two categories were reduced 6.8% and 4.4% respectively. New construction had seen a spike of 32% to start the year and that was the main reason that the overall value was inflated. This was eventually slowed by a cut of 2.2%, which resulted in a final sum of $241.40 million.

Retail was broken down into several subtypes by MCAD, painting a better picture than most commercial properties. Strip malls were No.1, achieving $881.73 million in taxable value following a large slice of 7.2%. Community shopping centers managed to lower themselves from second place to third place with appeals, cutting 6.6% in value to end up at $536.31 million. Neighborhood shopping centers were unfortunately elevated to the No .2 spot, though they did shed 3.6%. Malls received a reduction of 6.8%, while single-occupancy stores only got a cut of 2%.

Montgomery County Warehouses Appeals Bite into Record Gain

The taxable value of warehouses surged by 14% in 2025, reaching a combined total of $2.96 billion. When informal appeals and formal protests were added together, this resulted in a 7.6% reduction. The time of construction pattern held, with those built between 2001 and 2020 being the undisputed leaders with 53.2% of the value. This added up to $1.46 billion after a reduction of 5.5%. Those constructed from 1981 to 2000 got a cut of 5.3% but still managed to reach $555.24 million. New construction was right behind with $521.52 million and would have reached the No.2 spot if not for appeals. While new construction rocketed up with an increase of 50.6%, this was slowed by a cut of 13.3%.

Warehouses received only three subtypes. Generic warehouses had the most value at $1.16 billion, which was thanks to a reduction of 3.7%. Mini warehouses got a large reduction of 13.3%, which took them to $1.04 billion. Office warehouses were assessed the lowest with $666.65 million after a cut of 5.9%.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.